Fight Club and Entering The Market

When I see the rally I think “How does a new investor get into this without getting burned then not show up ever again?” It’s like the first day of fight club, only instead of soccer dads and cubicle surfers, it’s all MMA fighters and Mike Tyson. You might survive the first day, but it’s doubtful that anyone will come back after that. It’s a painful first lesson. But it’s a lesson, and that’s valuable.

The thing is, if you keep showing up to fight club with all those badasses you’ll quickly become like them because you’re rate of learning is higher than anyone else. Same thing with this market. It might humble you soon, but get in anyway and soak up everything you can. It’s part of many rules: show up repeatedly to what matters most. Whether it’s becoming the baddest of badass fighters, or growing your wealth over decades, show up.

My Investing Philosophy is Taking Shape

I’ve really been thinking about my investing philosophy and my way of doing things over the past couple of years. I think I’ve found it (for now): buy amazing companies at amazing prices. It might only be one or two buys per year, but that’s ok. The vast majority of my time is, and will be, spent thinking, watching, reading, and talking to people. Almost zero touching investments, and lots of saying ‘no’

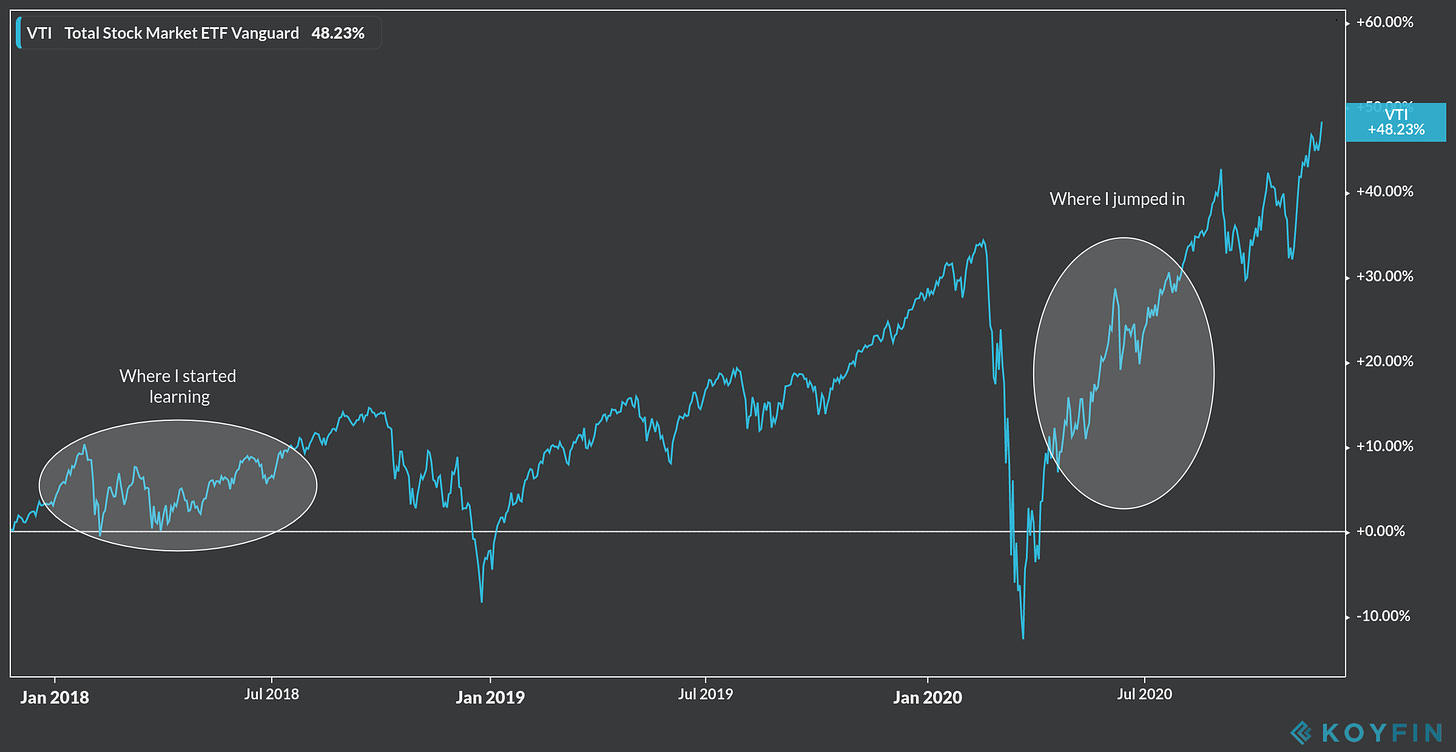

Here’s my experience starting my relationship with the market:

(note: VTI is shown as reference to what the market was doing at that particular time)

The range of emotions and lessons during this time was huge, and it’s still that way. I think we are going to come to a breaking point here, but what do I know? I haven’t read anything on Yellen, but I did buy Fed Up by Danielle DiMartino Booth.

Guard Your Decision Maker

Twitter is good for day traders, technical traders, etc, but it’s not good for buy and hold investors because it acts like an echo-chamber. It makes it easy to find the sliver of confirmation bias that we are all looking for. But here’s what I know: things are in a bubble right now. Greed is in full flow right now. How quickly we forget what happened less than a year ago, and how quickly it can happen again. It’s another reason I switched from fitness to finance: I want to be in a space that I cannot be easily shut down. A note: this picture is from a main ‘news source’ which means its extremely under-reported. If this is 69, then I’m putting it at 1,000.

Know your emotions.

Change

I’m changing the way I’m doing the newsletter. Instead of having a 3,2,1 layout like James Clear, Im’ going to write about what fascinates me. I know I’ll lose some of you because of this, but it’s a must if I’m going to continue this newsletter for years. I feel much better about this newsletter than anything i’ve sent in the past.

The website is coming along. I’m writing many long-form pieces and learning quickly every day. Thank you to the helpers on twitter for pointing me in the right direction for tools, as that has probably saved me years of headache.

If you have any questions please reply to this or DM me on twitter.